COGA Fact Sheet: Energy Demand 2050

According to the International Energy Agency (IEA), “U.S. emissions are now down almost 1 Gt from their peak in the year 2000, the largest absolute decline by any country over that period.” Part of that is due to fuel switching to natural gas, which is a low-carbon fuel. And, according to the EPA, methane emissions are being reduced while production increases. Here in Colorado, industry is making significant strides.

Methane is emitted with volatile organic compounds (VOCs), which contribute to ozone formation, so controls to mitigate VOCs also mitigate methane, and provide both air quality and climate change benefits. From 2011 to 2020, Colorado’s oil and natural gas industry saw a nearly 60 percent reduction in emissions, with models out to 2023 projecting further decreases, particularly in the nonattainment area.

That’s important because global demand for energy continues to grow, and the world will need climate solutions from the oil and gas sector. Headlines often focus on a coming “energy transition,” but analysis shows future energy production and energy demand being much more complicated.

Global Forecast

1 BILLION

Nearly 1 billion people in the world are without access to electricity.

10 BILLION

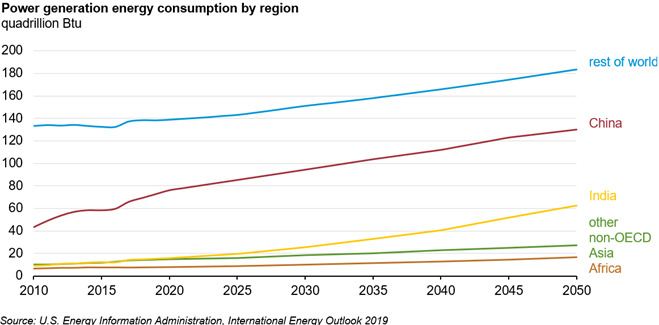

In 2020, there were 7.8 billion people on the planet, and by 2050 that number will grow to nearly 10 billion. Consequently, world energy demand will increase nearly 50 percent by 2050. Liquid fuels are forecasted to remain the largest source of energy, followed closely by renewables.

U.S. Forecast

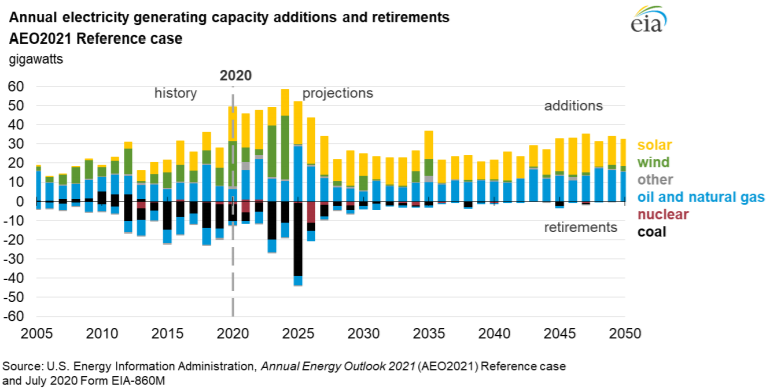

As is the case globally, electric power demand will increase on the domestic front through 2050. Renewables are predicted to eventually shoulder a majority of the necessary power generation, but natural gas will remain a critical electric resource.

Put another way, there will be a number of coal, oil and natural gas, and nuclear power units retired, but a significant amount of solar, wind, and new natural gas facilities will be needed.

U.S. consumer vehicle purchasing preferences will change slowly, as electric and hybrid car purchases increase, but gasoline powered vehicles will remain the largest portion of new car sales.

Colorado Example

The future of power demand and consumption in Colorado is complicated, especially as state legislators and regulators continue to make changes impacting energy production, power generation and transmission. For example, there are numerous large diesel and natural gas engines (>1,000HP) operating across the state, powering various pieces of equipment.

While it’s not possible, for argument’s sake, electrifying all of those engines would require 1,300 MW of new base-load, non-interruptible power. That would represent a 20-percent increase in statewide, non-interruptible generation. To build that electric generation, it would require several years of right-of-way and jurisdictional negotiations before constructing new transmission and distribution lines, as well as constructing large, new power generation that would cost several billion dollars.

Given the continuous, non-interruptible power needs, that power demand could not be met by intermittent renewable sources, and as a result likely means new coal or natural gas power generation facilities being constructed. There is line loss and other electrical system losses between the point of generation to the end user, load management and operational logistics in order to meet demand, as well as multiple new emission sources and possible leak points to control that previously did not exist.

Of course, the alternative is to remove these variables and simply build a better engine (below). One that runs cleaner, quieter, and effectively provides the necessary power. This example is important, because these are the real-life questions and scenarios regulators often face, and it demonstrates the complexity of current systems and the fallacy of being able to simply move to an all-renewable future. Every molecule, BTU, and watt matters, as well as how they are made and what they are made for.

Additional Resources & Information

Colorado Department of Public Health & Environment (CDPHE) | www.cdphe.colorado.gov

Regional Air Quality Council (RAQC) | www.raqc.org

U.S. Energy Information Administration | www.eia.gov